Secure Your Legacy: A Simple Guide to Estate Planning and Life Insurance

Planning your estate might feel overwhelming, but it doesn’t have to be. With the right guidance, you can protect your assets, minimize taxes, and ensure your loved ones are cared for. Here’s a straightforward look at what estate planning involves, how life insurance fits in, and why it’s crucial for your family’s financial future.

What Does an Estate Planning Attorney Do?

An estate planning attorney helps you organize your assets, create legal documents, and plan for the future. Here’s how they can guide you step by step:

Understand Your Goals

They’ll meet with you to learn about your financial situation, family structure, and long-term wishes.

Inventory Your Assets

From property to savings accounts, they’ll catalog your valuables and assess their worth.

Draft Legal Documents

Essential documents like wills, trusts, and powers of attorney ensure your wishes are legally binding.

Optimize Taxes

Estate tax planning helps maximize what you leave for your family.

Regular Updates

Life changes. Your estate plan should too! Attorneys will help you adjust as needed.

How Life Insurance Fits Into Estate Planning

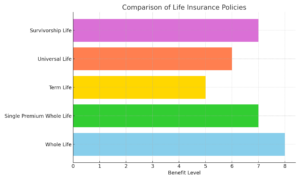

Life insurance is more than just a safety net. It’s a powerful tool for creating financial security, avoiding probate, and covering taxes. Here’s a quick breakdown:

Type of Policy Best For

Whole Life Insurance Long-term planning with cash value growth.

Single Premium Whole Life A one-time payment for simple, efficient wealth transfer.

Term Life Insurance Temporary coverage for mortgages or college tuition.

Universal Life Insurance Flexible premiums with cash value for estate liquidity.

Survivorship Life Insurance Covering estate taxes after the second spouse passes.

Riders (Policy Add-ons):

Accelerated Death Benefit: Access funds for terminal illness.

Long-Term Care: Cover healthcare costs without depleting savings.

Waiver of Premium: Keep coverage active if you’re disabled.

Why Estate Planning Matters

Key Benefits of Estate Planning:

Protect Your Family: Ensure your loved ones avoid costly probate and unnecessary stress.

Minimize Taxes: Keep more of your hard-earned money in your family’s hands.

Preserve Your Legacy: Pass down assets and values to future generations.

Get Started Today!

Don’t let your family’s future be uncertain. Take the first step toward securing your legacy. Contact Christopher at estatechecklist.com or email estatechecklist@gmail.com for professional estate planning advice.

Infographics & Charts

Estate Planning Process

Types of Life Insurance

Contact Us for a Free Consultation

Have questions or need guidance? Fill out the form below, and Christopher will be in touch.